In a significant move aimed at alleviating the financial strain on Pakistan's salaried class, the government has announced a comprehensive reduction in income tax rates across various income slabs for the fiscal year 2025-26. This decision marks a pivotal shift in fiscal policy, reflecting the government's commitment to providing substantial relief to lower and middle-income sectors.

Acknowledging the Burden

Finance Minister Muhammad Aurangzeb, during his presentation of the federal budget, acknowledged the disproportionate tax burden borne by salaried individuals. He emphasized that the government's primary objective has been to ease the tax structure for this segment, aligning with the Prime Minister's consistent efforts to lower taxes on salaried individuals. Aurangzeb stated,

"Keeping this objective in mind, we have proposed a decrease in income tax across all slabs. This measure will not only ease the existing tax structure but also strike a crucial balance between inflationary pressures and individuals' take-home pay by alleviating the tax burden."

Key Tax Relief Measures

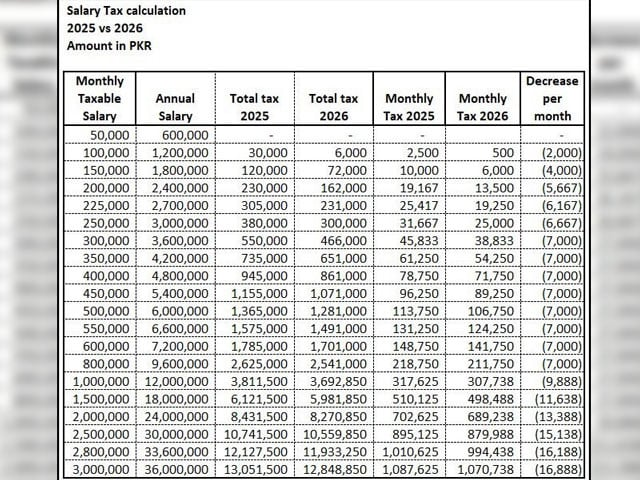

The proposed tax adjustments are as follows:

Income between Rs. 600,000 and Rs. 1.2 million per annum: A significant reduction in the tax rate from 5% to 1%, providing substantial relief to individuals earning between Rs. 50,000 and Rs. 100,000 monthly.

Income up to Rs. 2.2 million per annum: A 4% decrease in tax, lowering the rate from 15% to 11%.

Income up to Rs. 3.2 million per annum: A 2% reduction in tax, bringing the rate down from 25% to 23%.

Income exceeding Rs. 10 million per annum: A 1% decrease in the surcharge, aiming to mitigate the brain drain phenomenon by making Pakistan more attractive for high-earning professionals.

Addressing the Disparity

Historically, the salaried class in Pakistan has shouldered a significant portion of the tax burden. In the first seven months of the current fiscal year, salaried individuals contributed a staggering Rs. 331 billion in income tax, a figure 1,350% higher than that paid by retailers. Despite this, the government had not previously sought relief from the International Monetary Fund (IMF) for this marginalized segment. The new budgetary measures signify a shift towards addressing this disparity.

Economic Context and Future Outlook

The government's decision comes amid broader economic reforms aimed at stabilizing Pakistan's economy. The Finance Minister has emphasized the importance of maintaining macroeconomic stability and avoiding past boom-and-bust cycles. While the proposed tax relief is a step in the right direction, economists caution that it may not be sufficient on its own to drive substantial economic growth. Structural reforms, including broadening the tax base and enforcing agricultural income tax laws, are essential to ensure sustainable fiscal health.

Conclusion

The tax relief measures introduced in Pakistan's Budget 2025-26 represent a significant step towards easing the financial burden on the salaried class. By reducing tax rates across various income slabs, the government aims to provide immediate relief while fostering a more equitable tax system. However, for these measures to translate into long-term economic stability, they must be accompanied by comprehensive structural reforms and a concerted effort to broaden the tax base. Only through such holistic approaches can Pakistan achieve sustainable economic growth and ensure a fair tax system for all its citizens.

0 Comments